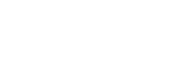

Is the euro a remarkable success story or inevitably bound for failure? Instead of joining the often ideological, inward-looking debate that is going on within Europe, Miguel Otero Iglesias, research associate at the EU-Asia Institute at ESSCA School of Management and senior analyst at the Royal Elcano think-tank in Madrid, decided to find out what financial élites in the so-called emerging markets of the BRICs and the Gulf think of it. His findings are now summarised in a new book published by Routledge in the prestigious Global Political Economy series.

Is the euro a remarkable success story or inevitably bound for failure? Instead of joining the often ideological, inward-looking debate that is going on within Europe, Miguel Otero Iglesias, research associate at the EU-Asia Institute at ESSCA School of Management and senior analyst at the Royal Elcano think-tank in Madrid, decided to find out what financial élites in the so-called emerging markets of the BRICs and the Gulf think of it. His findings are now summarised in a new book published by Routledge in the prestigious Global Political Economy series.

Miguel, your title includes a reference to “currency challenges”. In what way the Dollar has been “challenged” by the Euro, and to what extent that challenge has been serious or successful?

Yes, the concept of challenge is quite important in my book. First of all it has been a challenge to write it because its topic was a moving target. When I started my PhD in 2007 the global financial system was relatively calm, and then, all of a sudden, came the big storm. Both the euro and the dollar had to face the challenge of the global financial crisis.

Concretely on the euro vs dollar debate, I claim in this book that the euro has challenged the dollar in many ways. It all depends how we understand the term “challenging”. If we think it is toppling or substituting, then the euro has clearly not challenged the dollar. But if we understand challenge as a call to take up a fight, essentially as a contest, then the euro has certainly challenged the dollar. Despite its structural flaws it has shown the weaknesses of the greenback. In other words, using a more graphical metaphore, the junior euro has called for a fight and lost, but the senior dollar has come out with a bloody nose.

You have done extensive field work, mainly in form of élite interviews. In what countries did you conduct these interviews? What kind of individuals did you target and how many?

I interviewed around 120 financial elites in the central banks, the ministries of finance, the sovereign wealth funds, the commercial banks and the most prestigious think tanks and universities in China, Brazil, and several countries of the GCC (the Gulf Cooperation Council), namely Saudi Arabia, the United Arab Emirates and Qatar.

What does the perspective from emerging markets bring to the currency debate in Europe or the USA?

The opinion of these elites from emerging markets may be summed up like this:

1) The euro is a necessary and welcoming diversification tool against dollar unipolarity.

2) This first point relates to the first ideational challenge of the euro, which confirms that a multipolar monetary system is feasible and desirable.

3) The European Monetary Union is a harbinger, or precursor, for successful regional monetary integration in order to be better protected against dollar shocks. This is the second ideational effect of the euro.

4) However, the harbinger has gone under considerable fire in this crisis. It has survived for now, but we don´t know whether it will last in the long run. The Chartalist school of money, to which I subscribe to, and which is very popular in China, says that a monetary union cannot survive without a political union behind it.

5) Since the harbinger is struggling, some of the emerging powers, especially China and Brazil want to internationalise their own currencies. In this regard, the elites of the emerging markets do not want to depend any more on either the dollar or the euro. Here is when the first ideational challenge of the euro kicks in again, since the internationalisation process of the euro is here also a valid lesson to draw on.

6) Finally, it is also possible that the euro consolidates and that it provides an example of how a post-Westphalian multilateral monetary cooperation framework is possible. Keynes in the 1940s and Zhou Xiaochuan, the governor of the central bank of China, in 2009, have called for the creation of a supranational currency. With its strengths and flaws the euro is the closest we got to this dream, and thus this is the third ideational challenge of the euro to the dollar.

How realistic is this vision?

Here it is important to stress that the ideational might never become reality. The euro might break up, the internationalisation of the RMB might fail, and the US might revert its relative decline. As a result, the dollar might continue to be the undisputed primus inter pares. However, it might also be that this ideational challenge might lead to structural changes. There is certainly a lot of frustration about dollar hegemony in the emerging markets and the creation of the BRICS bank shows that the ideational can become reality. Hence, it might be that the euro will only be the first of a series of new challengers to the dollar.